Your quarterly dose of outsourcing, business, finance, and CX news and insights

Notes for this quarter from Bluebird

Unpredictability is becoming a defining quality as we kick off Q2. This edition of the Bluebird Quarterly takes a big-picture look at key metrics that can help us gain broader context of labor and employment in key sectors. We also look at factors impacting the supply chain for decision-makers, and potential adjustments to business operations with these variables in play. Finally, we look at the overlapping innovation in AI and healthcare that’s become a focal point for the world’s most influential startup incubator.

Snapshots: Labor & Employment

The Big Numbers

Employment Across Industries

Manufacturing employment declined from 13M to 12.9M between Jan and Nov 2024. [Investopedia]

April 2025 reporting from Reuters showed manufacturing is down (for now) as labor demand has declined. [Reuters]

Employment in technology remains very strong, with unemployment rates in the industry being reported at 2.5% last November. [Computer World]

Healthcare added 54K jobs in March 2025, showing steady, growing demand, despite ongoing issues with the workforce shortage [Health System Tracker]. Monthly average job growth in healthcare has been around 52K jobs per month for the prior 12 months. [Bureau of Labor Statistics]

Wages and Living Costs

Bureau of Labor Statistics: Real average hourly earnings increased 1.4% from March 2024 to 2025.

80% of respondents in a Pew Research Center poll say pay was not keeping up with inflation.

Income and price indexes are presenting a mixed bag as of late. While CPI continues to see a slight decline alongside energy prices (2.4% decline in March), consumer confidence has reached a low that compares to sentiments of January 2021.

Tariff uncertainty has roiled energy markets, which could deliver cheaper prices in subsequent months, but doesn’t necessarily bode well for consumers as pass-through costs from tariffs elsewhere have yet to hit the market.

Biz Ops: Supply Chains

While tariff negotiations continue, markets continue to react in a number of ways. Significant swings were recorded at the beginning of April as the first set of international tariffs went into effect. Major markets effectively erased 2024’s progress over a matter of days, but recovered as of April 9.

While broad short-term uncertainty remains concerning market performance, deregulation elsewhere lays the groundwork for more business activity.

Despite headlines, the global supply chain has remained stable since November 2024 (EY).

US PMI signals slower first quarter expansion amid rising prices | S&P Global

- Service sector growth rebounded in Q1, although this may be more pronounced due to adverse weather events that dampened activity.

- While output slowed among some sectors, technology and healthcare saw businesses grow during Q1.

- Manufacturing input costs rose in March (their highest since April 2023). Planners should expect costs to rise moving into Q2 and Q3 due to the delay in cost pass-through.

Are US Businesses Reshoring?

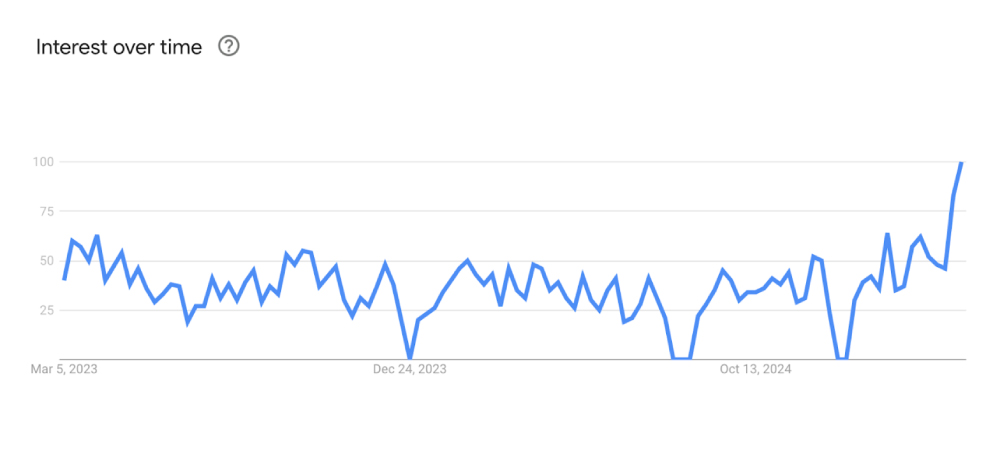

According to Google Trends data, searches for Reshoring have seen a surge of interest in the last month.

[Screenshot from April 9, 2025, https://trends.google.com/trends/]

Return to office (RTO) has been spinning up since the winding down of COVID-19-related mandates. The Trump administration has brought the majority of the federal workforce back to the office, and a number of notable companies have also implemented strict RTO policies.

While this is a positive sign for the commercial property sector that saw a drought in lease occupancies, it’s more nuanced for SMBs.

Flexibility is becoming a defining feature, with tech and healthcare, in particular, seeking to balance the stress and strain of burdensome workloads with flexible in-office arrangements ([Med City News, Techtarget). Employee well-being remains a top consideration for many SMBs aiming to balance productivity with attractive work benefits [CIO Dive].

As AI becomes an increasingly helpful tool for boosting productivity and replacing monotonous workflows, the dual benefits of hybrid work and AI assistance for employers and employees are likely to become a standard feature for most workplaces.

Trends at the Intersection of Healthcare and Technology

90% of healthcare workers are using AI in some form. [AHA: 2025 Health Care Workforce Scan]

80% of people 18-34 are open to using generative AI for routine healthcare interactions. [PwC]

YCombinator x Healthcare

Famed incubator YCombinator is backing a number of AI-powered healthcare startups this year. Growing focus in the industry on preventative and value-based care is seeing innovation take many forms.

- Akido Labs: Utilizes artificial intelligence to provide accessible healthcare services, such as offering AI-assisted medical care to ride-share drivers in New York City, ensuring timely and affordable healthcare access.

- Lucira Health: Develops cost-effective, disposable health diagnostic hardware that transforms smartphones into portable, real-time health-monitoring devices, enabling rapid analysis of bodily fluids.

- Clipboard Health: Operates an app-based marketplace connecting healthcare professionals with facilities, allowing professionals to book on-demand shifts and facilities to access necessary talent, thereby improving workforce flexibility.

- DrChrono: Offers a comprehensive platform for medical practices, integrating electronic health records (EHR), practice management, and medical billing services to streamline healthcare operations.

Two Quotes: Inspire and Act

“Be passionate and bold. Always keep learning. You stop doing useful things if you don’t learn.”

–Satya Nadella,

CEO of Microsoft

[Inc.]

Maria Bartiromo:

“Do you expect a recession?”

Jamie Dimon:

“Probably, it’s a likely outcome.”

[Fox Business]

Bluebird: Workforce Solutions for Business Leaders

Bluebird helps businesses gain cost-effective, indispensable team members who arrive on day one prepared to deliver quality outcomes. Since our founding, we have helped healthcare organizations succeed in delivering excellent patient coordination and handling payer-facing processes. We now have integrated solutions for technology and SaaS organizations, helping improve customer experience, product development, sales, and marketing.

We are unlike outsourcing organizations. Our approach means your business gains an integrated team of professionals who mesh seamlessly with your workflows and company culture.

Stay Connected

Sign up to receive our next newsletter and future business insights

Launched in 2021, Bluebird is a symbol of innovation and resilience. Our mission is to enhance the efficiency and growth capacity of businesses. Through tailored remote workforce solutions, we help technology, retail, hospitality, and healthcare organizations deliver meaningful customer experiences and ease the burden of critical business processes.